29/12/ · Your 30 minutes call option wins and the 15 minutes put option losses. You will have earned $ from the 70% call winnings and the 15% consolation refund from the put option (the opposite can happen, put option wins and call option losses). Both the call and the put options end up in the money. You will get $ ($+$) Expiration out of the money in binary options trading is the situation in which the asset’s price goes into the wrong direction when the expiration time comes, and you end up losing your investment 21/5/ · Expiry Date – The time when the binary options asset expires. In the Money – When you accurately make a prediction and win a payout, then you are ‘in the money’. Out the Money – If you lose a binary options trade, it is referred to as “out the Money”.Estimated Reading Time: 7 mins

Binary option - Wikipedia

The Long Shot binary options strategy is a strategy wherein a trader buys an option that is way out of the money in hopes that the price of the underlying asset will move a long distance across the strike price, binary options at the money out of the money. Its name, long shot, means just that. This strategy has a low chance of success but can result in massive payouts when done correctly. The long shot binary options strategy requires the trader to invest only a small amount of money with the prospect of a larger payout.

The profits can be large when traders use this strategy, and the losses are much smaller. Commonly, the strategy needs to succeed 5 times for an investor to see a really big profit, binary options at the money out of the money.

This attractive reward is what motivates binary options traders to stay glued to the market sentiment and master this strategy. While the long shot binary options strategy may be known for its great rewards, it is also definitely associated with a higher level of risk. But even so, the long shot strategy only needs to pay off a few times in order produce impressive payouts after paying off the recovery from out of the money trades.

With the long shot strategy, traders may just find themselves earning higher profits that is only available by entering riskier trades. The long shot strategy can be deployed in any type of underlying asset. The idea is to purchase a contract with a predicted price that is way outside the strike price.

Obviously, if the strike price of the underlying asset is further away, the less likely that the trade is to be successful. However, the good news is that even small investments can result to large profits should these trades end in the money. If so, the strategy would have been fruitful to the trader. Any trader can execute the long shot strategy using any binary options broker. The objective of initiating trades that possess pre-determined target prices that are located levels away from their opening values is a basic feature that any binary options broker should provide.

In fact, some brokers even have payout ratios that are directly proportional to the gap between the opening and target prices. This allows the trader to determine how much to invest and to expect. Risk ratios are set up so that greater payout binary options at the money out of the money given for larger differences because it is the nature of trading where risk dramatically increases the further away the target price is from its opening.

But then again, traders only need to generate a limited number of wins to record a substantial profit, binary options at the money out of the money. Technical and fundamental analysis should be performed with this strategy. As the most basic step, the trader must be able to determine the general direction that the asset price is currently moving in. After knowing the trend, determining whether the asset price will reach a predicted price level is a much different story.

Binary options brokers are aware of its difficulty. That is why they are willing to offer high payout percentages should the prediction be correct.

When a trader uses the long shot strategy in trading binary options, he will notice that the strategy will result in more out of the money trades than in the money one. But because the long shot provides a higher payout, profit can be made even if the trader is successful in only one out of five times.

The long shot strategy is best used whenever the prevailing market conditions are volatile exhibiting large price surges or spikes. It is most effective to use when traders detect that the market is in such conditions.

When market sentiment does not match price levels, tendencies are that trends will prevail. As the markets would not have properly priced-in such eventualities, traders will immediately have excited investors on their side. They will initiate rapid trading transactions in order to modify their investment portfolios in accordance with the new underlying trading conditions. Consequently, the markets will experience surges in volatility which are the ideal conditions for implementing the long shot strategy in their trades.

Any trader can instigate such a technique by first identifying a target level that price must hit at binary options at the money out of the money once before expiration. The further this level is from the opening value of the new binary option, the larger the size of the payout ratio. More specifically, returns increase in direct proportion to the distance of the two levels. To illustrate how the long shot strategy works, imagine the following scenario.

Say that the Bank of England has just informed the markets that it has just cut its benchmark interest rates in order to boost the struggling British economy. As such, the trader decides to initiate a long shot strategy. These options are available in Touch or No-touch options. After the preferences have been set, the target and opening prices of the new position will be displayed.

The trader then puts in his investment and activates the new PUT binary option. Traders should know well to use a proven money strategy to assist in identifying the safest amount to wager that will not expose the account to an excessive level of risk.

This gives them the opportunity to try again, just in case the first few trades end up out-of-the-money. Sound investment is always first in trading, binary options at the money out of the money. While the trade is going on, prominent details of the position, such as payout ratios, option type, and invested amount, will be shown.

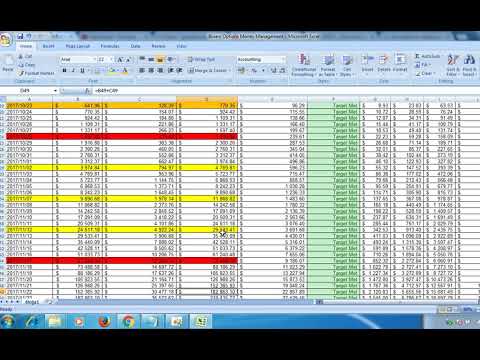

The trader can track the option using a graph or binary options at the money out of the money similar tool provided by the binary options broker. Many brokers share the same configuration. The red horizontal line is normally utilized to identify the exact time that the option will expire. At expiration, the long shot strategy terminates.

Brokers who provide a rebate could give traders some compensation. However, binary options at the money out of the money, the secret to this strategy is to hold the position and try again. If the readings from the traders analysis are true, then he should be able to make a profit from the appropriate trades. Learn more strategies here. Meanwhile, you can check out our list of top brokers so that you can start trading today. The Long Shot Binary Options Strategy Contents Mechanics of the Strategy When to trade the Long Shot Example Share and Enjoy!

Share and Enjoy! Read more articles on Strategy. Binary Trading.

HOW TO AVOID LOSING MONEY WITH BINARY OPTIONS - BEST BINARY OPTIONS SOLUTION

, time: 8:11Out of the Money (OTM) Definition

29/12/ · Your 30 minutes call option wins and the 15 minutes put option losses. You will have earned $ from the 70% call winnings and the 15% consolation refund from the put option (the opposite can happen, put option wins and call option losses). Both the call and the put options end up in the money. You will get $ ($+$) 14/12/ · While out-of-the-money options are typically viewed as the more "aggressive" of the two, there are potential upsides to purchasing these types of An option with a strike price that is out of the money is an option that has no intrinsic value. For example, if a put with a strike price of gives you the right to sell

No comments:

Post a Comment